2023 Craft Beer Preview

Craft Beer hasn’t had it easy lately and 2023 isn’t going to be any different. Depending on your interpretation of a recession, we’re either in one, or will be there shortly. Market pressures are pushing the price of beer up as much as 20% from pre-COVID levels in an effort to keep up with costs, but consumer wages aren’t maintaining pace, with layoffs already underway in some industries. Any craft brewery not planning to step up their marketing efforts and invest bigger in their brand is going to be fighting an uphill battle in the coming years, or is already listed for sale.

Unless you’re getting really specific, it’s hard to make bold predictions that aren’t already playing out. Craft beer evolves quickly, but not that quickly. That being said, here’s 23 thoughts about ‘23:

Bet, Check, or Fold

#1 - Bet

It’s okay to say that the next 12-24 months are going to be challenging, in fact, say it with me now. BUT, some of the best businesses are launched, pivoted, or perfected during a recession and this stretch will be no different. I’m not sure that the Warren Buffet quote “Be Bold While Others Are Fearful” is exactly what I’m saying here, as that implies you have excess capital to deploy. But believing in yourself, betting on your team, staying confident & optimistic, and outworking your competition has never been more important.

#2 - Check

The big breweries smell blood in the water. They are ready to get aggressive and box small breweries out (more so than usual). The more you pull back and the more passive you become, the more open runway you create for the sharks. Surviving and advancing is crucial right now, living to fight another day, but understand that checking to your more aggressive opponent is going to encourage a raise ♠️ .

#3 - Fold

Some brewery owners never made great beer, never hired enough talented people around them, and/or never knew how to run a sustainable business. Others made good beer and hired talented people, but forgot to ensure that the key people would stick around.

Some brewery owners never built a brand that resonated with consumers, drove loyalty, nor kept consumers excited to see what’s next. Others had good timing in their early days and made the right styles of beer, but their luck ran out.

Some brewery owners realized that the bigger they got, the more HR became part of the job, when they just wanted to focus on the beer itself. Other brewery owners turned out to be assholes and represented the HR-risk themself.

Regardless of the reason, a significant number of breweries are for sale or have been sold in the past year. Some are of great value and truly worth every penny. Others are worth zero, or worse. Expect to see more interesting sales, depressing closures, and everything in between. You won’t be able to keep up and the action is already underway.

The State of IPA

Regardless of your feelings toward IPAs, they still represent 49% of craft beer, 55% if you include Pale Ales, 60% if you conservatively. include half of all variety packs. Their success dictates the tone for the majority of the industry and can pay the bills necessary to champion other styles. It’s getting more and more challenging to make IPAs feel new though, which was the recipe for the last decade of success. Here’s what to look forward to, or dread, in 2023:

#4 - The IMPERIAL IPA March

The industry tried its best to push a narrative centered around the low-ABV styles that brewers seek out at the end of a shift. With an aging consumer base, there is plenty of logic to this approach. But the more “sessionable” you go, the farther you stray from what made craft beer so compelling in the first place. While so many were going low (in alcohol), New Belgium decided to go high, and now everyone else is trying to catch up. To the extent you haven’t already, look for craft breweries to release more imperial IPAs, resurrecting old ones and line extensions of existing brands.

Note: This was pulled in late November 2022

#5 - Session’s Demise

Founders essentially created the Session IPA category, the 15-pack format, and the aggressive pricing strategy that had many breweries chasing ✋. Nearly ten years in, the All Day brand is definitely losing a bit of it’s luster, down 12%, but still gigantic and powerful. With no other Session IPAs in the Top 40 IPA/Pale Ales and the category leader showing chinks in the armor, I don’t expect to see much focus here in 2023 from competitors. Founders has looked toward the Cold IPA trend to breath some new life into the All Day family as they have too much to lose. Do others have enough to gain by putting a high priority on a new Session IPA? I say no.

Nobody:

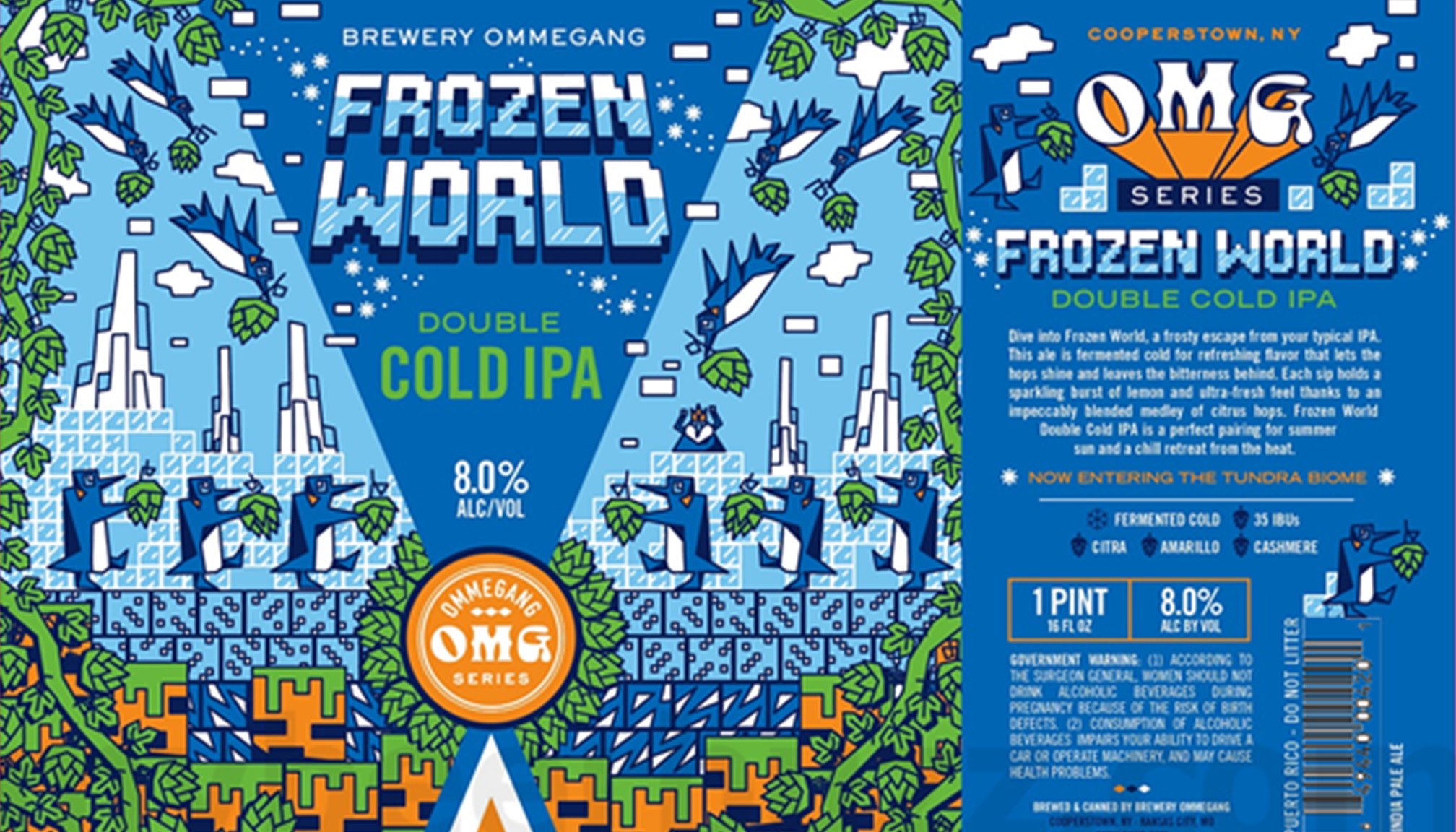

#6 - The Double Cold IPA

Speaking of Imperial IPAs and Cold IPAs, expect to see craft beer do what craft beer does, and combine the two. I’m not sure who is asking for these or what problem they’re solving, but upping the ante on two of the hottest IPA trends shouldn’t really surprise anyone. These also continue to back the theory of craft beer going back up in ABV%, especially within the IPA style.

#7 - The Tweener (🚨 Personal plug)

Tweener is a professional wrestling term for a character who has qualities of a good guy and bad guy. I don’t know if this will be a wider trend, but I decided to advocate for our IPA innovation at Revolution Brewing to steer toward a gray area in between Classic and Hazy IPAs, searching for every way possible to combine “the best of both worlds”. If both sides could come to the center of the aisle and get some of what they want, could the universe return to balance?

Still Lagering

Well it turned out that 2022 wasn’t the year of the craft lager and I’ve got bad news…2023 isn’t going to be either. But damned if craft brewers aren’t going to continue trying to crack this nut.

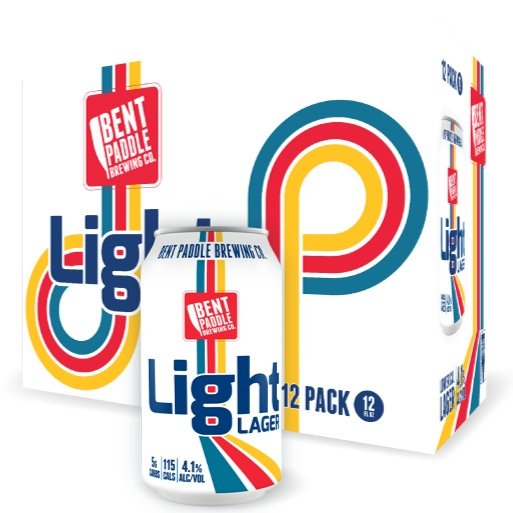

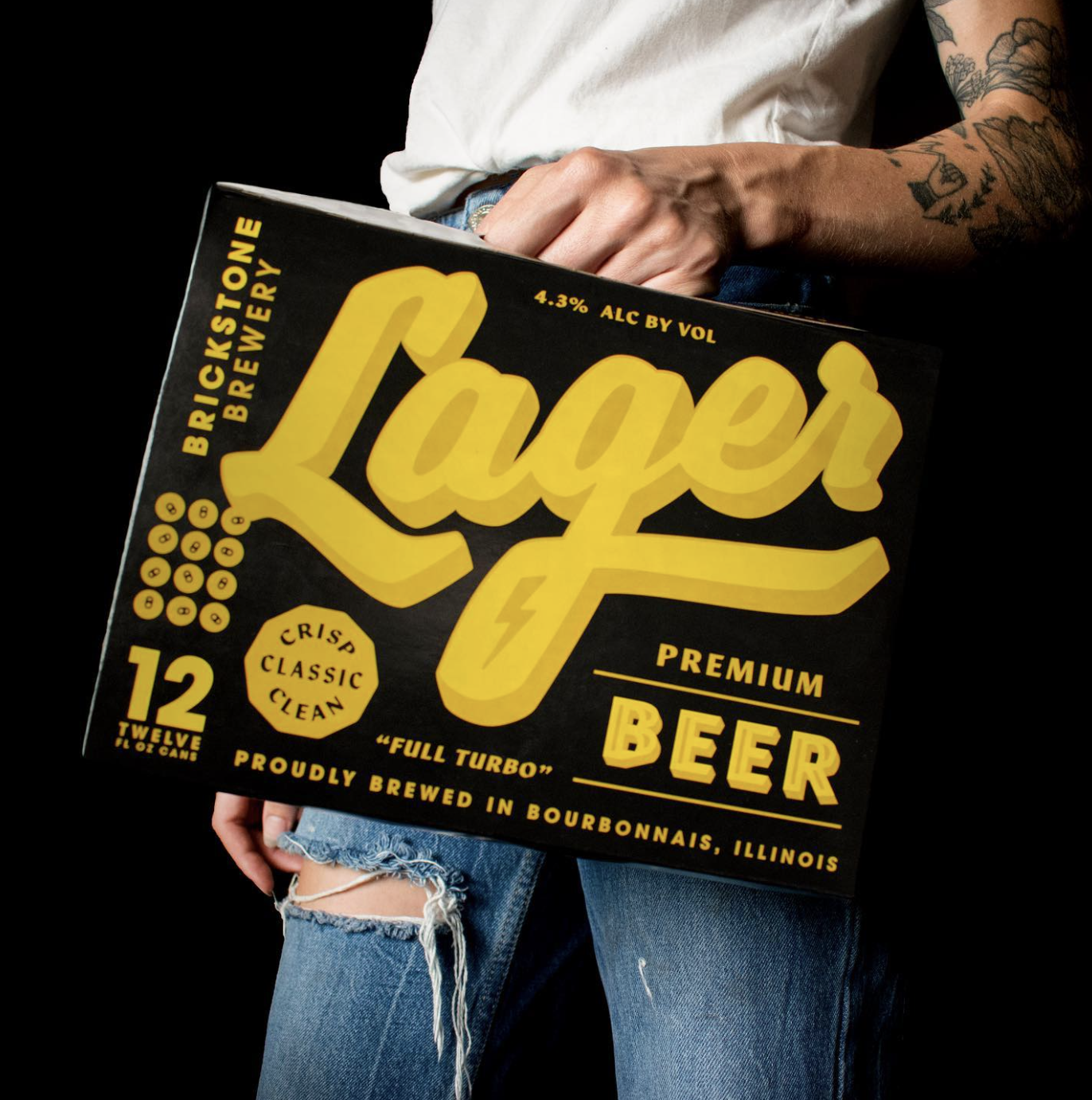

#8 - The Present Day Throwback

Adding a value option to portfolios during choppy economic times is worthy of consideration. Craft brewers will be looking for a means to offer volume and aggressive pricing, which typically means a light lager or golden ale. Craft can differentiate themselves by avoiding adjuncts and highlighting the Premium quality with fancy new words. Marketing teams will want the packaging to be “cool” and look toward brands like High Life, Banquet, and Pabst’s nostalgia brands for inspiration, or perhaps Montucky Cold Snacks is the best example. But there in lies the challenge…

Montucky Cold Snacks is the entire brand, therefore it’s the company’s #1 priority. An existing brewer looking to create a “Montucky Killa”, as the 4th or 5th most important thing they do, is probably going to fall on their face. The exception of course, as always, involves a big cash investment in marketing. The Firestone Walker strategy for “805” has worked so well in part because, as I understand it, they sought outside help to manage that brand and make it go 💥 . By investing heavily in marketing the beer AND lifestyle, most visibly with billboards blanketing busy California roads, the brand resonates up and down the California coast.

#9 - Lager with a Twist

Look for other craft brewers to dip into the old macro playbook with riffs on lagers with a little extra “something something” that help bring in an even more casual audience. I’m talking about using salt & lime, cheladas, and maybe even…

#10 - Mango 🥭

If you look at the Top 50 “Craft” Beers in scan data, you’ll see the majority of them are down over prior year. One of the exceptions is Mango Cart, a Wheat Ale with mango from Anheuser Busch-owned Golden Road out of Los Angeles. Up 10% and bucking the trend by outselling their IPAs, Mango Cart has become the most successful chess piece obtained in this 2015 acquisition.

America’s oldest craft brewery Yuengling seems hell bent on figuring this mango thing out and attracting some younger consumers. They just introduced Bongo Fizz, a 4.5% ABV reformulation of their 6% Raging Eagle, moving away from their typical American Eagle motif and opting for a French Bulldog and a Parrot sitting on the beach. With Pittsburgh’s IC Light Mango winning the hearts and minds of party-going Yinzers, the battle for Pennsylvania mango supremacy is on. I didn’t have this one on my bingo card.

#11 - The Hoppy Lager

While the style name “Cold IPA” triggers many brewers from a technical standpoint, the actual execution of a hop-forward lager tends to be a welcome concept to most. Like an IPA, Cold IPAs originally started falling in that 6.5% - 7.0% ABV range, so I expect a heavier push than ever behind “Hoppy Lagers” that fall more in the traditional craft lager range of 5.0 - 5.5% ABV.

Going cheap, throw-back artwork, fruit, and hops will put a fresh coat of lipstick on craft lagers, but I don’t see any of these or any other trends facilitating a major tilting of the scales. As lager-focused breweries continue to pop up in each market, these specialists will continue earning the majority of the style’s attention in 2023.

Souring Interest

#12 - Bung Deal

The writing has been on the wall for quite some time that barrel-aged sours, in most cases, can’t carry an entire brewery. Sour programs that used to have waitlists for memberships began turning to IPAs a few years ago to help make the operation viable. While each has their own set of unique circumstances, some are beginning to throw in the towel as we’ve seen breweries like Denver’s Black Project close for good and Berkley’s The Rare Barrel get folded into San Francisco’s Cellarmaker. Barrel-aged sours have had so much working against them, including:

The style was generally abandoned by beer traders during the rise of Hazy IPAs & Pastry Stouts, which were built around more relatable themes and flavors

Sours rose to popularity in an era where MORE sour was often interpreted as better

High price point + Low ABV = Low Perceived “Value”

Not enough credit given by consumers for the barrel + time + nuance

Breweries were slow to adapt to small format bottles, which limited occasions and lead to bloated beer cellars which saw no improvement during COVID as library sales took place to blow out inventory

The kettle sour offering “sour” and approachability for cents on the dollar by comparison

#13 - Kettle Still Boiling

Barrel-aged aged sours may face an uncertain future, but their kettle sour counterpart continued to grow in 2022. While most styles took an “L”, an approachable price point allows these “quick sours” to appeal to a significantly wider base, furthered by the use of likable fruits and familiar themes like Lemonade. The tempering of acidity levels and rise of beverages like Kombucha has made the sour beer profile less foreign to new, younger craft beer drinkers.

The English

For breweries who have their core offerings set, but have flexibility to take a few risks with their smaller batches, some are turning back to the English styles that had a more stable presence in the 2000s when Brewpub culture set the tone. A lot of today’s craft beer consumers weren’t engaged then, so how do you get them to appreciate the maltier side of the pond?

#14 - The Pub Ale

In the sense that “lager” is a pretty wide tent that can encompass a wide range of drinking experiences, “Pub Ale” is an umbrella term over many English-style beers. Yet, more and more, I’m seeing the term on draft lifts and cans from Chicago breweries celebrating these classic styles. “Pub Ale” can sound a lot more inviting than “Ordinary Bitter”, which if you think about it is a pretty brutal style name to a bright-eyed new craft beer fan.

#15 - Mildly Interested

Okay, so this one falls more in the “willing it into existence” category, but a well made 3.8% ABV English Mild is just about as perfect of a beverage that exists in this crazy world. They have all the flavor that I love in a barrel-aged English Barleywine, but without the risk of waking up in my neighbors front yard again. The liquid itself also has the opportunity to appeal to the hyper-engaged, Barleywine is Life movement. But how does English Mild bridge into this high octane clique and add a little more cool factor? I don’t have the right answer to this one, and I’m not saying they should be called “Session Barleywines”, but I’m not saying they shouldn’t either…

White space in NA

#16 Restraint Vehicle

You’ve probably already heard the obvious benefits to introducing an NA product into a craft brewery’s portfolio, but allow me to present one that you may not have heard yet: Internal Culture. When you work at a brewery you’re presented with an overwhelming number of situations involving drinking that can lead to an unhealthy lifestyle, or much worse. Many are moving on to other industries as a result. The presence of an alternative to alcohol that’s woven into the company’s objectives will help promote restraint, social acceptance, and reduce burnout from your team.

#17 - mo’nA’polY

Still early in its lifespan, Non-Alcoholic beer will continue to be one of the few craft categories up 📈 in 2023. With one dominant player, backed by famous athletes and now a cash infusion from Kuerig Dr Pepper, competition better bring their “A” game. In scan data, Athletic Brewing sold over 8X the NA beer of Brooklyn Brewing, Brewdog US, Two Roots, Wellbeing, and Partake, combined. While I think there’s absolutely room for small competitors like Untitled Art to continue springing up and differentiating themselves, I’m not convinced that anyone will make a real run at Athletic Brewing. To do so would require big cash investment which is extraordinarily expensive in this economy.

I’m much more bullish about…

#18 - Hop Water 💧

In the feedback loops that I’ve created on Instagram and TikTok, I hear an overwhelming appreciation for Hoppy Sparkling Waters compared to NA beers. From the broader consumer, Hop Water tends to be cheaper, zero calories, and more refreshing while scratching a similar itch. For breweries, the capital investment is small by comparison, the turn time is faster, and consumer expectations are easier to meet. Both the fear and opportunity is this emerging segment’s unknown ceiling.

Marketing House in Order

While working in Marketing at a Craft Brewery, there’s an unlimited number of strategies you could be pursuing and as a result, there’s never a feeling that your job is done, especially in this climate. To the extent this isn’t already happening, I expect more and more breweries to get better focused on two key areas: how they look on the shelf and how they’re talking to consumers.

#19 - Packaging Continuity

Now more than ever, breweries cannot afford to be confusing consumers and they need to be elevating their overall brand, not just individual beers. Look for a large swath of breweries to invest in a refresh of their label art trying to accomplish the following goals: 1) present as “fresh” and modern, with 2) enough familiarity with the old look to avoid confusion, 3) improved continuity between brands, lining up well on a shelf, 4) tighter language, 5) simplification.

#20 - The QR Code Breaks Late

Like many new technologies, QR Codes were the butt of many jokes in the 2000s (invented in 1994). People are generally afraid of what they don’t know or understand, so while they stuck around, they never really gained mass adoption until recently. There’s never been anything stopping a craft brewery from putting a QR code on their cans, linking to a video of their brewers tasting through the beer with you, explaining how it came to be, and/or showing you how it’s brewed. Yet I think 2023 is where we see a major push into this type of marketing and education.

#21 - It’s Not Me, It’s You

Breweries who complain about Facebook and Instagram’s algorithm may need a self-awareness check. The old tech industry adage is, “if it’s free, then you are the product” and while the free ride to promoting craft breweries on these mediums isn’t over, it’s now more complicated. In so many cases, breweries were putting out a weak product for far too long in their content and their posts were buried as a result.

The algorithm isn’t designed to get you to buy ads, the algorithm is designed to show users the GOOD content (while hiding the bad) so that they stay on the app longer, THEN are willing to scroll through more ads while they’re being entertained. If users feel they’re being sold to or aren’t hooked into a video early, they zoom right past it, which tells the Algorithm to show this post to less people. That’s what’s been happening to craft breweries and if that didn’t happen, users might move on to an app that’s going to entertain them more, like TikTok. Good content still wins, you just have to work harder for it.

#22 - Reeling For Likes

2022 was the year that my 2019 prediction came true: Breweries finally started getting on TikTok. But Instagram, which is the #1 social media platform for most breweries, isn’t going down without a fight. While engagement is way down on the Instagram platform, Reels are being presented as the way to reach your audience. Breweries who play the game are being rewarded with more views. But breweries need to stay creative as consumers are tired of seeing the same old jokes. Be original, give more than you ask, and you will be rewarded.

#23 - Ignore EVERYTHING I Just Said

It would behoove craft brewery leaders to limit the degree that they’re relying on other craft breweries for inspiration. We don’t need breweries and brands who are a copy + paste of others. I recommend spending time absorbing content, reading articles, and paying attention to trends outside of the craft beer bubble. Choose the interests, niches, and universes that bring you joy and dive deep into their subculture. That’s where you’re going to get the best inspiration on how to bring something truly unique to craft beer, not from this blog post. And find a balance between taking these economic conditions very seriously, while taking a few risks that your whole organization is behind. I’ll see you on the other side ✌️ ♥️ .

-Doug